Protection from third-party claims

Commercial general liability is a must when running a business. As you work with the public, many unexpected events will happen. It's not "if" you run into a claim, it's when. A slip or fall in your business that causes someone serious injury can cost you anywhere from $20,000 - $50,000. Without coverage, that could come straight from your business bank account.

According to www.insureon.com, 1 in 3 small businesses face liability claims.

Having an insurance company help cover your business operations will protect you and your company from risks. The financial security of your business is vital to keep your doors open.

The good news is, general liability is easy and affordable to obtain. It protects your business from massive costs related to accidents, property damage, or other liability claims.

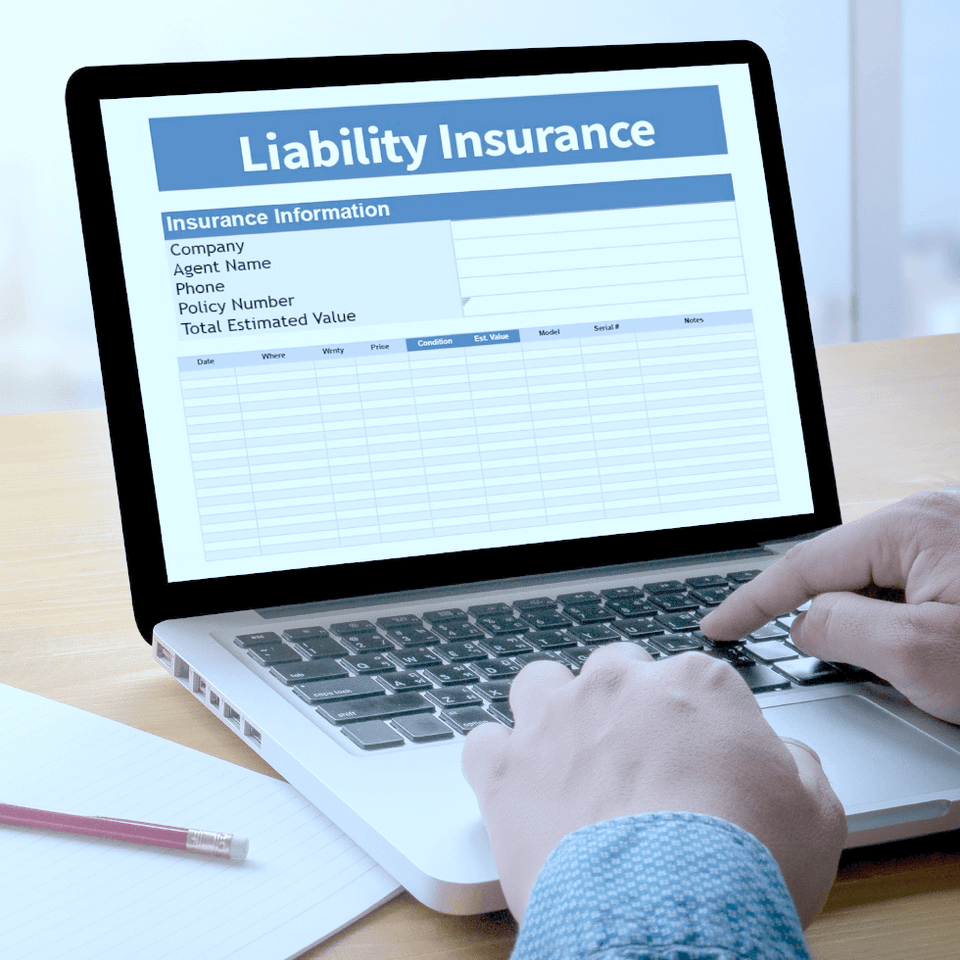

According to www.insureon.com, 1 in 3 small businesses face liability claims.

Having an insurance company help cover your business operations will protect you and your company from risks. The financial security of your business is vital to keep your doors open.

The good news is, general liability is easy and affordable to obtain. It protects your business from massive costs related to accidents, property damage, or other liability claims.