What is inland marine insurance?

Inland marine insurance is property coverage for property in transit that offers coverage whether it’s on-site or on the road. This includes equipment and other assets your business owns. Items frequently covered include:

Although this transportation insurance protects your assets in the event of accidents, theft, or other losses, it’s important to remember these assurances go way beyond what you’d receive from a regular automotive liability policy. These inland marine coverage and cargo insurance plans are far more versatile.

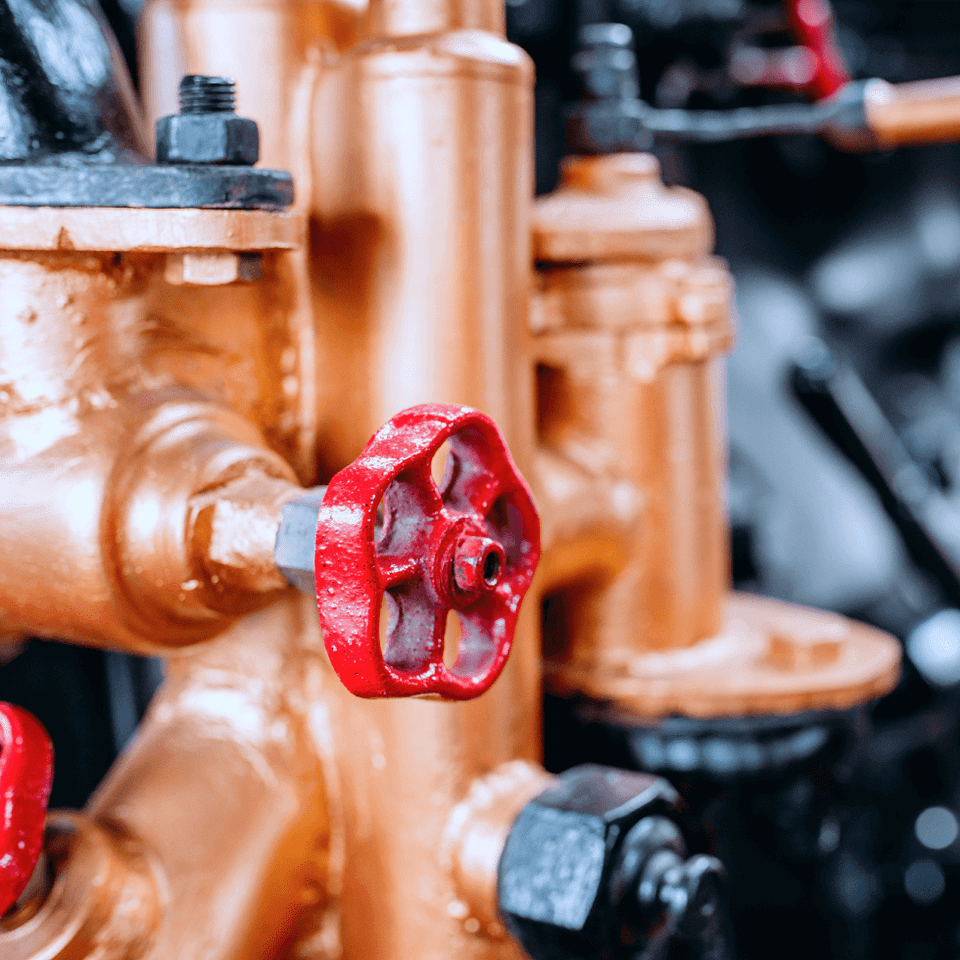

If your equipment and property need coverage for whatever reason, it can be covered under these policies. Equipment breakdowns, like HVAC or a walk-in freezer, are covered under equipment breakdown insurance.

- Cameras, computers, and media equipment

- Tools and construction hardware

- Veterinary and non-veterinary animals

- Appliances and other goods sold by dealers

- Communications devices and equipment

- And more

Although this transportation insurance protects your assets in the event of accidents, theft, or other losses, it’s important to remember these assurances go way beyond what you’d receive from a regular automotive liability policy. These inland marine coverage and cargo insurance plans are far more versatile.

If your equipment and property need coverage for whatever reason, it can be covered under these policies. Equipment breakdowns, like HVAC or a walk-in freezer, are covered under equipment breakdown insurance.